Virginia LLC Processing Time Calculator

LLC Processing Options

Your Virginia LLC Timeline

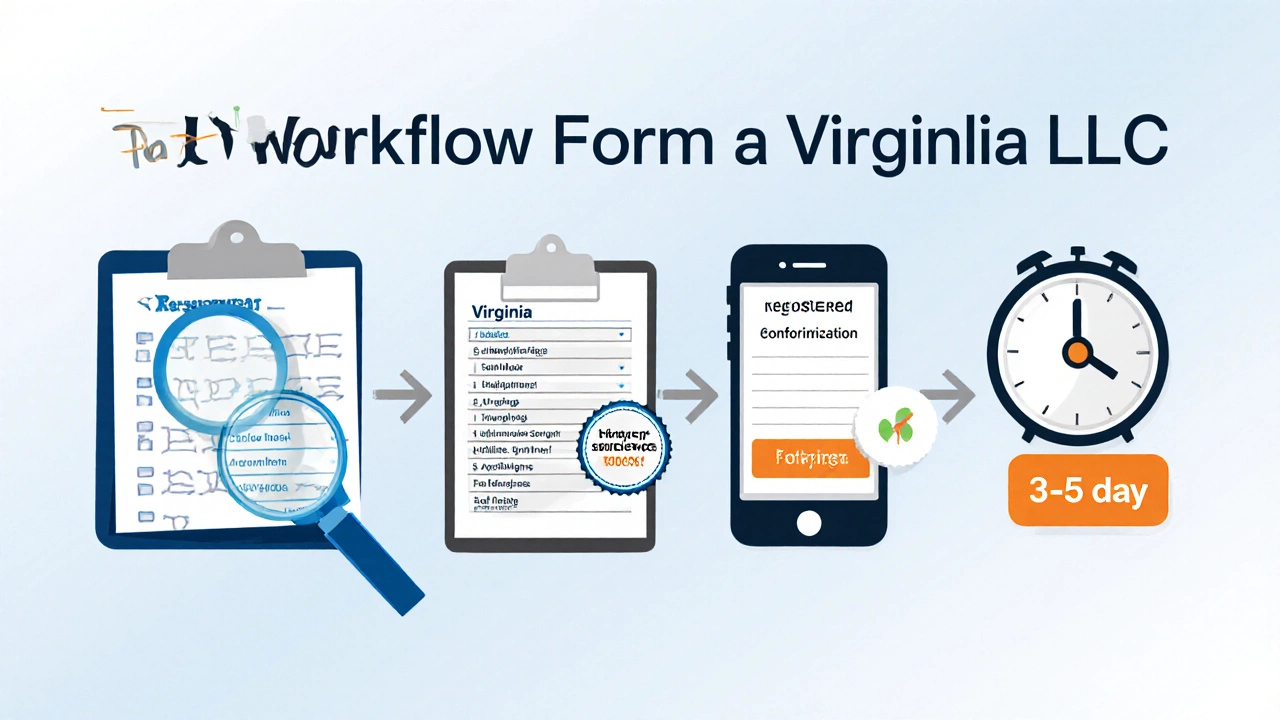

If you’re eyeing a new venture in the Old Dominion, the first question on most entrepreneurs’ minds is: Virginia LLC processing time. Knowing how quickly you can move from name idea to a legal entity helps you plan launch dates, secure funding, and lock in contracts. Below we break down the exact steps, typical wait times, fast‑track options, and hidden pitfalls that can stretch the clock.

Key Takeaways

- Standard filing via the Virginia State Corporation Commission (SCC) usually takes 3‑5 business days after online submission.

- Expedited processing (same‑day or next‑day) is available for an extra $50‑$100.

- Delays often stem from incomplete Articles of Organization, missing Registered Agent details, or unpaid filing fees.

- Overall cost ranges from $100 to $250, covering filing fees, registered agent services, and optional EIN procurement.

- Once approved, you’ll need an EIN, operating agreement, and any required local business licenses before you can start operating.

What Is an LLC and Why Choose Virginia?

Limited Liability Company (LLC) is a business structure that protects owners' personal assets while offering flexible management and pass‑through taxation. Virginia is a popular home for LLCs because it combines relatively low filing fees, a streamlined online system, and a business‑friendly legal environment. Whether you’re a solo founder, a partnership, or a small corporation, the LLC model lets you separate personal risk from company liabilities without the rigid formalities of a corporation.

Step‑by‑Step Timeline for a Virginia LLC

- Choose a unique name - Perform a name search on the SCC portal. This step takes a few minutes but can add a day if you need to brainstorm alternatives.

- Appoint a Registered Agent - The agent must have a physical address in Virginia. Services are available 24/7; confirmation usually arrives instantly.

- Prepare the Articles of Organization - A simple form that includes the LLC name, registered agent info, and management structure. Online filing auto‑populates many fields, so completion typically takes 15‑30 minutes.

- File online with the SCC - Pay the $100 filing fee (plus any optional expediting fees). After submission, the system issues a receipt and begins processing.

- Processing period - Standard processing averages 3‑5 business days. Expedited options can shrink this to same‑day or next‑day turnaround.

- Receive the Certificate of Organization - Delivered via email for standard filings; expedited filings may provide a PDF download within hours.

- Obtain an EIN - Apply through the IRS website; you’ll get the number instantly after confirming your LLC details.

- Draft an Operating Agreement - Not required by the state but essential for internal governance and banking purposes. Completing this can take a few hours to a day, depending on complexity.

- Secure local licenses or permits - Depending on your industry and city, this step can add another 1‑2 weeks.

Overall, the core formation (steps 1‑6) can be wrapped up in under a week if you avoid common slip‑ups.

Standard vs Expedited Processing

| Option | Typical Processing Time | Additional Cost | When to Use |

|---|---|---|---|

| Standard | 3‑5 business days | $0 | When you have flexibility in launch dates |

| Expedited - Same Day | Within 24 hours | $100 | Critical contracts or funding deadlines |

| Expedited - Next Day | Next business day | $50 | Need a quick start but can wait a day |

Common Delays and How to Avoid Them

- Incomplete Articles of Organization - Double‑check that the LLC name matches exactly what you searched, and that the registered agent’s address is a physical street address, not a PO box.

- Payment Issues - The SCC only accepts credit cards and electronic checks. A declined transaction will halt processing until you resend payment.

- Name Conflicts - If your chosen name is too similar to an existing entity, the system rejects it instantly. Have a backup name ready.

- Missing Registered Agent Consent - Some agents require a signed consent form. Using a reputable third‑party service typically eliminates this step.

- Delayed EIN Application - The IRS will reject an EIN request if the LLC’s certificate isn’t uploaded correctly. Save the PDF certificate from the SCC before applying.

Costs Overview

- SCC filing fee: $100 (standard) - required for all LLCs.

- Expedited processing: $50 (next‑day) or $100 (same‑day).

- Registered agent service: $75‑$150 per year, unless you use a personal Virginia address.

- EIN (Employer Identification Number): Free when applied directly through the IRS.

- Operating agreement template: $0‑$99, depending on whether you draft it yourself or purchase a legal form.

Adding everything together, most entrepreneurs spend between $100 and $250 to get a Virginia LLC up and running.

Next Steps After Your LLC Is Approved

- Open a business bank account using your Certificate of Organization and EIN.

- File your annual report with the SCC (due each year on the anniversary of formation; $50 fee).

- Register for state taxes if you’ll have employees or sell taxable goods.

- Update contracts, invoices, and marketing materials with the new legal name.

- Consider getting a Virginia Business License from the city or county where you’ll operate.

Following these steps ensures you stay compliant and can focus on growing your business rather than chasing paperwork.

Frequently Asked Questions

How long does a standard Virginia LLC filing take?

After you submit the online form and the $100 filing fee, the Virginia State Corporation Commission typically processes the Articles of Organization within 3‑5 business days.

Can I file my LLC on the same day I decide to start?

Yes, by paying the $100 same‑day expedited fee you can receive a Certificate of Organization within 24 hours, provided all information is correct and the payment goes through.

Do I need a Virginia address for my Registered Agent?

The Registered Agent must have a physical street address in Virginia. A PO box is not acceptable. Many entrepreneurs use a professional registered‑agent service that meets this requirement.

Is an Operating Agreement required in Virginia?

Virginia does not legally require an operating agreement, but banks and investors usually ask for one. It also clarifies ownership, profit sharing, and management duties, helping avoid future disputes.

What additional licenses might I need after forming an LLC?

Depending on your industry and locality, you may need a city or county business license, a professional permit (e.g., health, construction), or a sales tax permit. Check with the Virginia Department of Taxation and your local government.